Given the financial turmoil that is hitting international markets (especially the US), it is not surprising that Techcrunch posted and article delving into the issue of venture capital in this tumultuous time. I agree with the majority of the article, except I think that there is another angle in play.

The general market turmoil caused by the credit crunch is certainly going to reduce the number of wealthy investors that are throwing money into VC funds. However, at the same time we are witnessing a sharp shift in the perception of risk associated with hedge funds and other leveraged investing strategies. As investors withdraw their money from those funds there is definitely the potential that some of that money will in turn flow into venture funds that are now perceived as slightly less risky than before, on a comparison basis.

The article is definitely worth a read. Check it out below and leave your comments here.

VC’s (and Startups) Won’t Be Immune to the Credit Crisis: Techcrunch

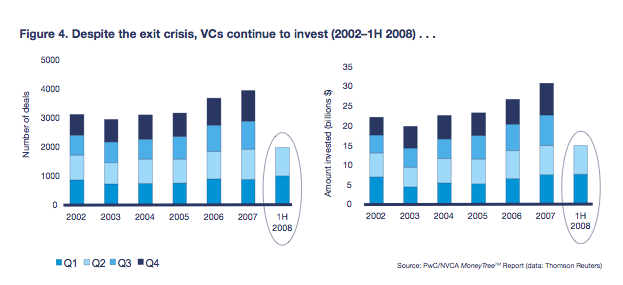

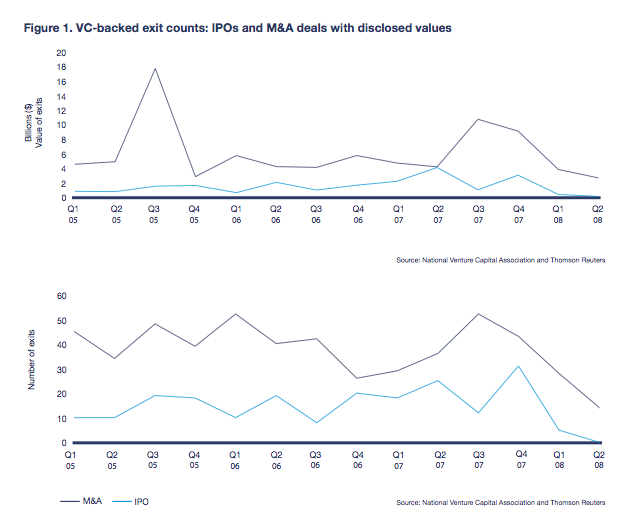

So far the downward spiral of credit and financial markets seems to have left venture capital firms and startups relatively unharmed. Even though the IPO market closed completely in the second quarter (and opened again only slightly in the third), venture capital firms continue to raise money and invest in startups at a healthy pace. During the first half of the year, venture capital firms raised about $16 billion in 141 funds and invested about $15 billion in nearly 2,000 deals.

.

I recently came accross your blog and have been reading along. I thought I would leave my first comment. I dont know what to say except that I have enjoyed reading. Nice blog.

Tim Ramsey